Annual

results

report2021

Promoting low emission, climate-resilient recovery and maintaining climate ambitions during the pandemic

Raising Ambition, Empowering Action

It was another year of uncertainty and upheaval for the world in 2021, but also a year in which the Green Climate Fund (GCF) continued to make huge strides forward, strengthening its support for climate action in developing countries.

The Fund approved new climate financing to a record level of nearly USD 3 billion and its portfolio reached the USD 10 billion mark in GCF resources, totaling USD 37 billion in co-financing.

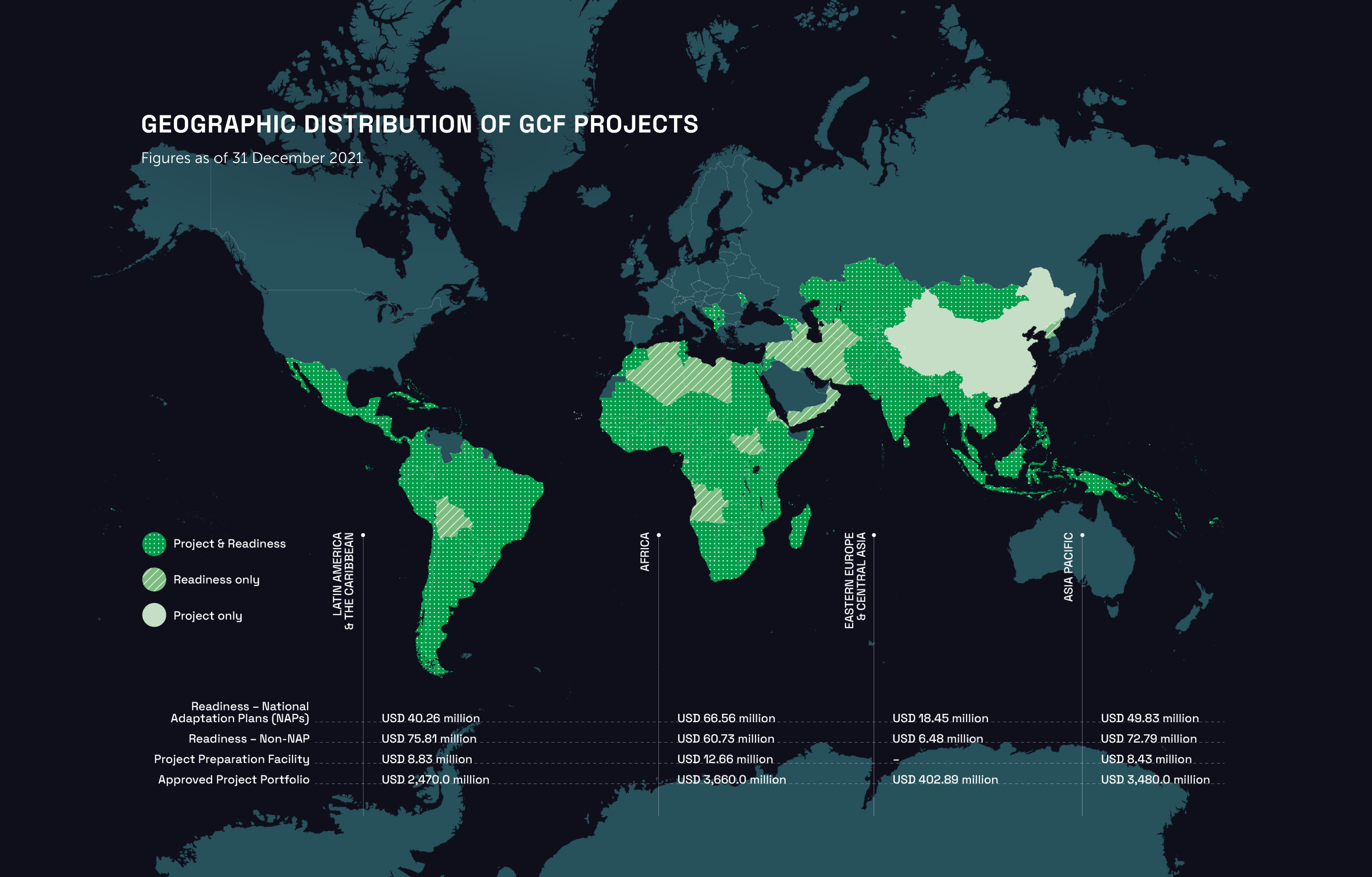

With 190 projects in 127 developing countries, GCF is delivering on its mandate to support low emission, climate-resilient development pathways.

GCF’s Annual Results Report 2021 details how GCF continued to accelerate its support to developing countries in responding to the climate crisis, especially in the context of a climate-resilient recovery from COVID-19.

I am proud to say that as the world’s largest dedicated climate fund, GCF is in a stronger position than ever to fulfill our mandate of promoting a paradigm shift towards low emission and climate-resilient development pathways, and supporting developing countries to raise and realise their climate ambitions in line with the objectives of the Paris Agreement and the UN Framework Convention on Climate Change.

Yannick Glemarec

GCF Executive Director

Read the letter from the ED

Pathways

- Establish enabling environment for novel climate solutions

- Catalyse innovation

- Strengthen national financial institutions to drive adoption of novel climate solutions

- De-risk and mobilise finance at-scale

How GCF drives the paradigm shift to a low emission, climate-resilient pathway

Innovations in policy, culture, institutions, sciences, technology, management, and finance are key to tackling the climate crisis. While innovations are being developed around the world, developing countries are often not able to take part due to barriers to investment in climate innovation.

GCF helps developing countries overcome the barriers so they can realise their climate ambitions. GCF does this through a transformational approach based on four complementary pathways. These four pathways form the strategic foundation of GCF’s work, informing its programming and operations.

A unique fund

GCF has several unique features that allow it to be the main global fund for climate finance.

Country-driven

GCF empowers developing countries to lead programming and implementation

Open partnership organisation

GCF works for, through, and with partners to deliver climate results.

Flexible range of financing instruments

GCF uses various financial instruments to pilot new financial structures for green market creation.

Balanced allocation to ensure adaptation finance

GCF is mandated to invest 50:50 of its resources into mitigation and adaptation, with most adaptation resources going to the most climate-vulnerable countries.

Risk-taking, patient capital

GCF supports early-stage project development and climate innovations, catalysing climate finance and enabling partners to raise their climate ambitions.

Strong safeguards

GCF has environmental and social standards to ensure positive impacts for the environment and society, and robust risk management to protect against corruption, abuse and fraud.

Result areas

GCF seeks to make an impact within eight mitigation and adaptation result areas

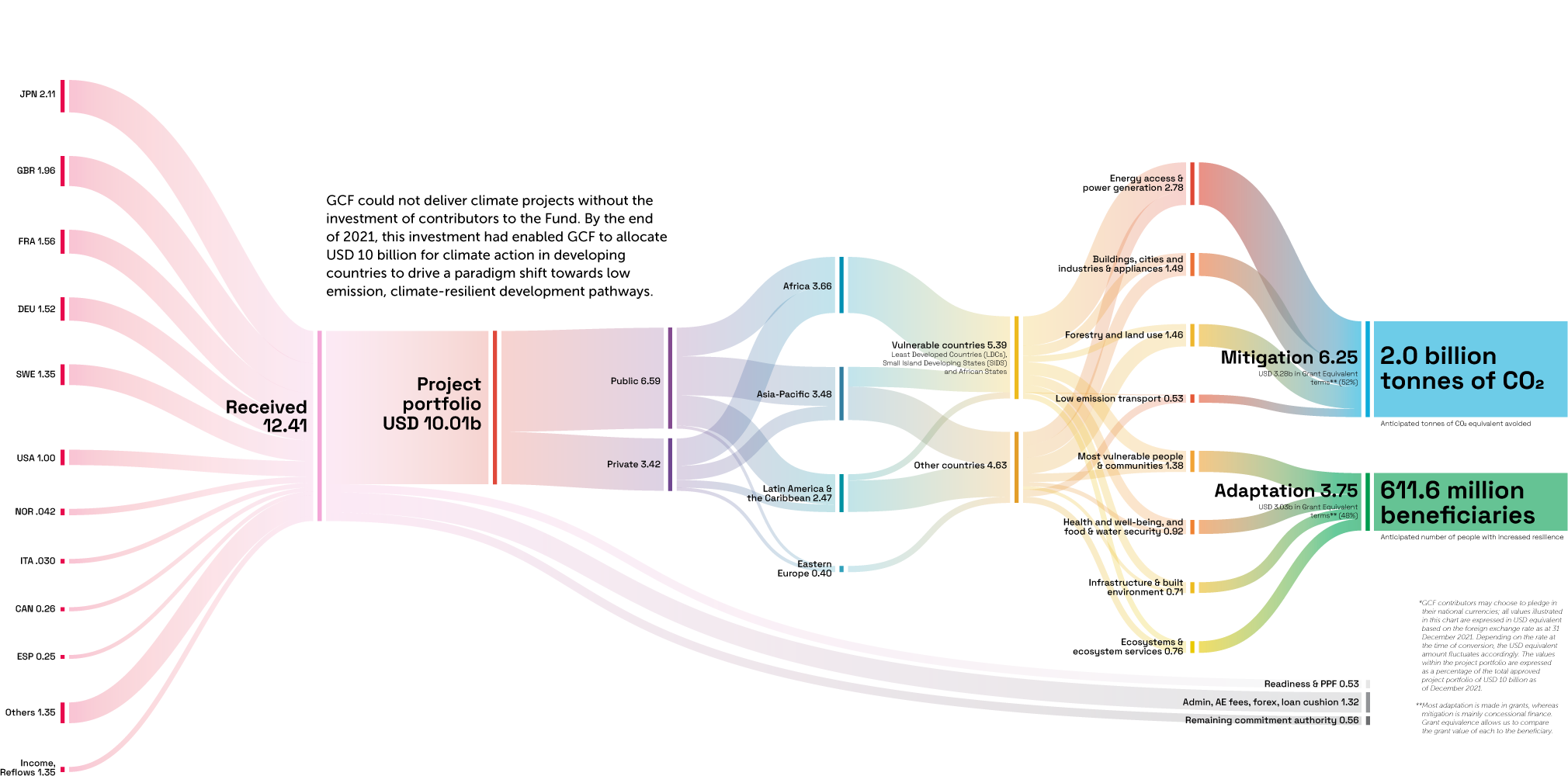

GCF snapshot (in USD)

0

0

+

0

0

0

0

0

Approved projects value by theme

(Grant equivalent*)

Approved projects value by priority countries

10 New Accredited Entities

*Nominal values are used throughout unless it is indicated that figures are grant equivalent. The grant equivalent calculator tool, developed by the Office of Risk Management and Compliance of GCF, converts the value of different grant and non-grant instruments into a comparable grant equivalent value. The grant equivalents were estimated for each project using a uniform 5 per cent discount rate.

Fostering a Paradigm-shifting Portfolio

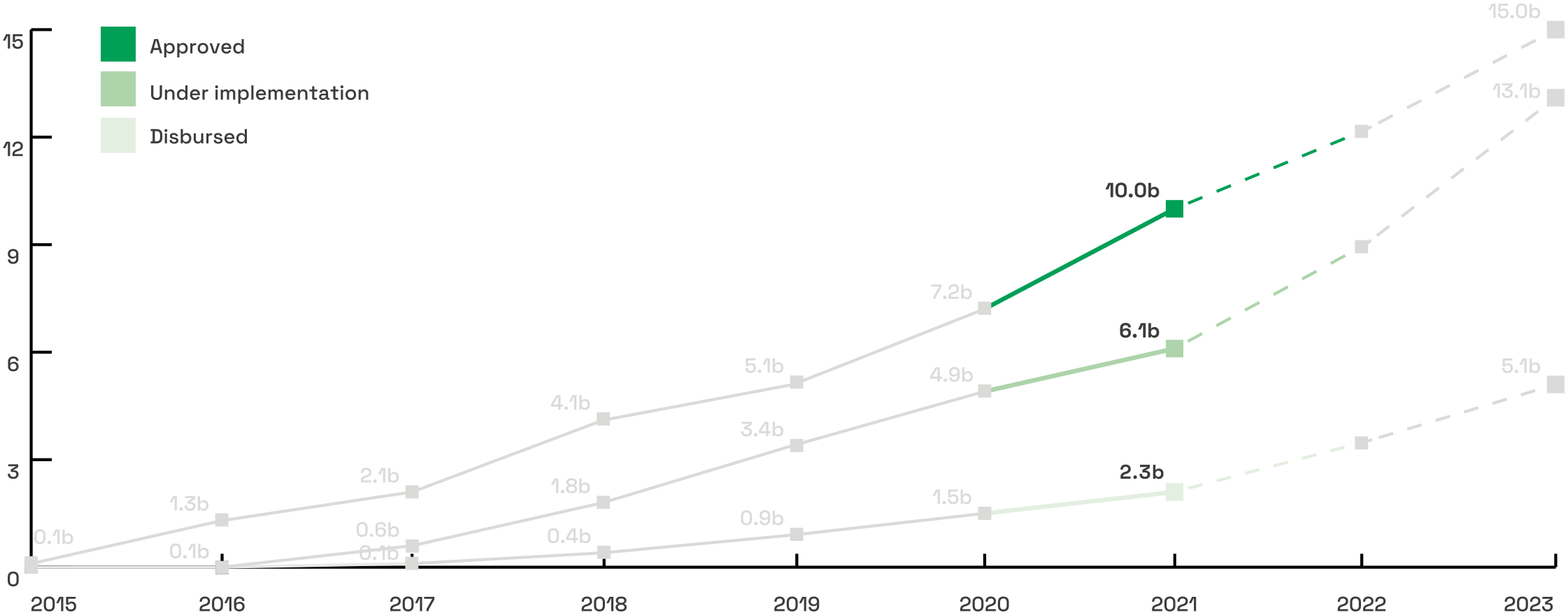

In 2021, GCF programmed nearly USD 3 billion for 32 new projects. By the end of 2021, the GCF portfolio reached USD 10 billion in GCF resources with 190 projects in 127 countries.

The year saw the approval of diverse projects across various result areas with novel approaches that will help vulnerable countries become climate-resilient and recover from the COVID-19 economic fall-out. Adaptation, direct access, and private sector mobilisation were common themes.

Projects were approved for the first time in 10 countries - Botswana, Central African Republic, Congo, Guyana, Malaysia, Sao Tome and Principe, Somalia, Suriname, Thailand, Trinidad, Tobago.

Projected portfolio growth

In 2021, GCF approved nearly USD 3 billion in new climate projects. By 2023, the portfolio is expected to reach USD 15 billion.

New project spotlight

see All approved projects

Use ecosystem-based approaches

Multi-country programmes that focus on ecosystem restoration and enhancing ecosystem services to protect against climate change impacts.

Promote innovation and technology

Pioneering projects that introduce new climate innovations and technologies.

Implementing the Portfolio

In 2021, the GCF portfolio under implementation reached USD 6.7 billion by the number of approved projects. Disbursements reached USD 2.3 billion, increasing the total funds disbursed by 53 per cent since 2020.

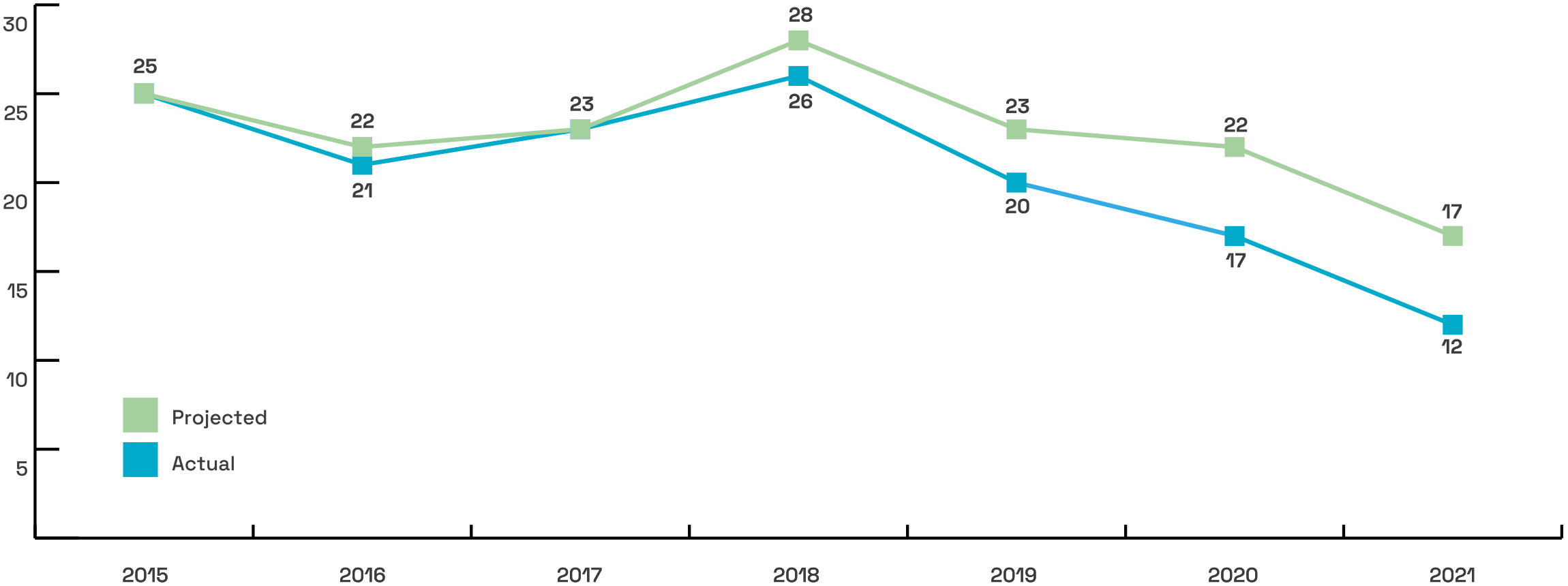

Time taken from proposal review to first disbursement of funds

GCF is delivering finance more quickly. Median times from funding proposal review to disbursement have decreased over the past few years.

By the end of 2021, GCF’s portfolio delivered 54 MtCO2e of reduced emissions and benefitted 14 million people directly and indirectly. The total portfolio is expected to deliver 1.980 MtCO2e of reduced emissions and reach 588 million beneficiaries.

Stories of real-life impact

The solar power will do a huge job, reducing the usage of grid energy…people need water, it is a necessity, so the solar power grid is going to be very important for water pumping.

Chase Ashby

Engineer for the Barbados Water Authority

See how GCF is making an impact

in Malawi and Barbados

I've been farming the old-fashioned way for a long time, and now with the climate changing we can hardly grow our rice and yields are getting lower.

Sim Dany

Farmer from Kam Pong Cham Province, Cambodia

Working smarter and

faster to deliver

climate finance

To ensure the delivery of high-impact programming for countries most in need, GCF has been making strides in executing with greater speed, efficiency, effectiveness, transparency and predictability.

With a maturing portfolio, GCF has been focused on safeguarding projects. In 2021, it adopted the Integrated Results Management Framework, enhanced review processes for better results tracking, and expanded portfolio management systems.

It bolstered its project risk management approach, as set out under its Risk Management Framework and related policies. Roles and responsibilities for risk assessment, mitigation and management were prioritised and mainstreamed across the Fund and independent units to combat integrity violations.

GCF has zero tolerance for project integrity violations (e.g., corruption, fraud, abuse, and other prohibited practices). The Fund has three lines of defence to prevent, identify, and manage risks end-to-end from accreditation to funding proposal review to implementation. For more information about accountability, please see here.

© Shibasish Saha / Climate Visuals Countdown

GCF has been developing its own set of environmental and social safeguards and reviewing its country ownership guidelines to ensure they are in line with best practices for local stakeholder participation and community engagement.

Gains were made in swifter programming. The median time from Board approval to first disbursement fell from 19 months in 2018 to 10 months in 2021, and a project in the Federated States of Micronesia moved from approval to first disbursement in only 36 days.

The gains were a result of comprehensive improvements made across GCF such as strengthening partner engagement and programming guidance and streamlining and digitising processes and procedures, a part of GCF’s digital transformation.

In 2021, 80 per cent of codified GCF processes were automated, covering funding proposal and Readiness review, accreditation, portfolio management and administrative support. The year also saw the launch of the Portfolio Performance Management System (PPMS).

Besides efficiency, digitisation helps GCF become more cost-effective. An independent review found GCF was more cost-effective compared with its peers. As its portfolio grows, GCF will become even more cost-effective by the end of 2023 when its portfolio is anticipated to reach USD 15 billion.

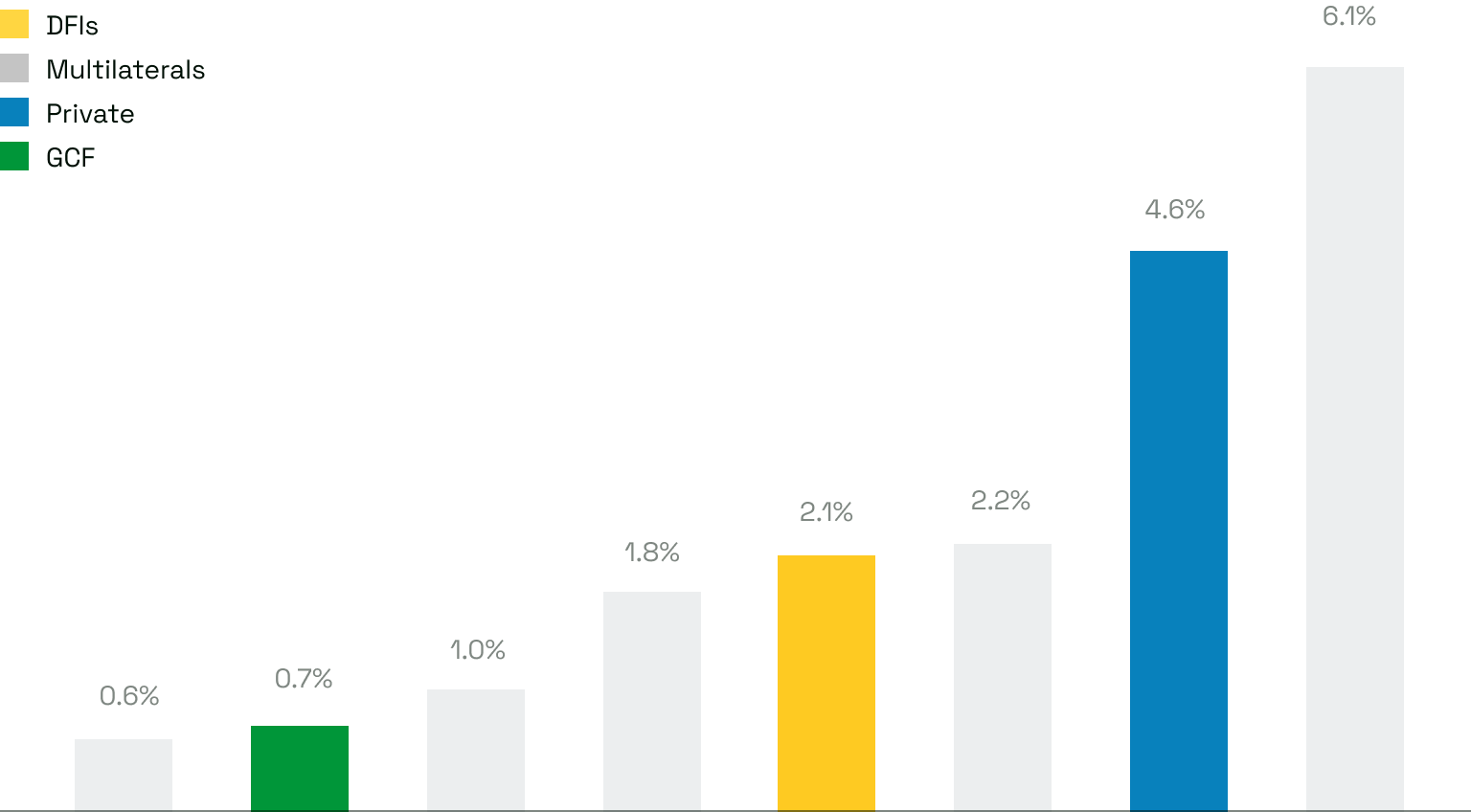

Cost effectiveness compared to peers

A study undertaken by Dalberg Global Development Advisors found that GCF was more cost-effective compared with other multilaterals and development finance institutions.

In line with the expansion of its portfolio and more sophisticated policies, processes and systems, the Fund is preparing to increase its staff capacity to the next level. In 2021, the Board approved an increase in the Secretariat headcount to 300 in 2022 and 350 in 2023. The GCF People Plan and employee value proposition will be key to attract and retain talented and committed staff.

Strengthening

country ownership

The GCF Readiness and Preparatory Support Programme has allowed the Cook Islands to strengthen our institutional capacity and empower our people to prepare for climate change impacts and increase our country’s resilience to those impacts.

Mani Mate

Development Coordination Division Director, Ministry of Finance and Economic Management, Cook Islands

A key GCF tenet is empowering developing countries to lead programming. GCF guides and engages with country partners to translate their Nationally Determined Contributions (NDCs), adaptation plans and climate strategies into plans, policies and investment responses, and to develop GCF-aligned concept notes and funding proposals.

In 2021, GCF’s Readiness Programme and Project Preparation Facility (PPF) - were leveraged to further advance project ideas into concept notes and to enable Direct Access Entities (DAE) to play a greater role in programming. An action plan was developed to provide more programming support for DAEs, integrating Readiness and PPF tools and to provide more training.

Useful Links

- Readiness Support

- Project Preparation Support

- Learn more about GCF’s Request for Proposals, Project Preparation Facility and Simplified Approval Process

Increasing access to

GCF resources

GCF is a partnership institution, working for, through and with partners to deliver climate results. Accredited Entities (AE) are key as they enable developing countries’ access to GCF resources and deliver impact through project implementation.

GCF has been standardising and digitising tools and processes to increase ease of access for its partners. Some of the initiatives include developing ICT systems to allow countries to track progress of funding proposals and an online onboarding programme.

In response to country and AE requests for more guidance and support, GCF strengthened programming guidance, technical assistance and partner dialogues. These include the development of sectoral guides that identify climate investment opportunities along low emission, climate-resilient pathways in 10 sectors. Stakeholder consultations were conducted on eight of the guides in 2021.

Also under development is an appraisal manual that describes GCF’s investment criteria and appraisal process for concept notes and funding proposals; it follows the release of a programming manual in 2020 that describes the project approval process and preparation and submission of a funding proposal to GCF.

During GCF’s side event at COP26, Aiyaz Sayed-Khaiyum (Fiji Attorney General and Economy Minister), Mia Mottley (Barbados Prime Minister), Md. Shahriar Alam (Bangladesh Foreign Minister of State), and Yannick Glemarec (GCF Executive Director) discussed how to channel climate investments in addressing the adaptation gap in developing countries and small island developing states (SIDS).

Strengthening

partnerships

GCF continued to build its AE network by accrediting 10 AEs in 2021 - of which nine were DAEs and three from the private sector. A new digital accreditation platform will be deployed in 2022 to improve the efficiency and transparency of the accreditation process. GCF also strengthened partnerships with other climate funds.

Direct Access

We deeply appreciate the effective, efficient running of GCF as a partner. Our partners are ready and enthusiastic to begin work on the ground and we cannot thank GCF enough.

David Panuelo

President of the Federated States of Micronesia

Partnerships with Direct Access Entities (DAE) were in the spotlight as their engagement can strengthen country ownership of programming and deliver climate finance close to the ground. Initiatives were taken to further engage and support DAEs through GCF’s Readiness Programme and Project Preparation Facility (PPF), and training and onboarding such as regional DAE workshops in Africa and Asia.

Direct Access quick facts

- 71 total number of DAEs accredited (63 per cent of the AE portfolio) as of the end of 2021.

- 58 countries having at least one DAE (national or regional) as of the end of 2021.

- Share of DAE programming out of total programming increased 17 per cent (in grant-equivalent terms) in 2021

Private sector

Partnerships with the private sector are crucial as they can promote wider financial flows towards low emission and climate-resilient development pathways. In 2021, the Private Sector Facility (PSF) portfolio grew by USD 783 million and six new projects, bringing private sector programming to USD 3.4 billion out of the total portfolio of USD 10 billion. The new projects leverage GCF’s risk-taking and diverse financial instruments to mobilise private investment at-scale and build new markets for climate action in vulnerable countries.

If we just look at traditional investing, we are not going to reach the 230 million people who are the hardest to reach on the planet. We need to recognise that in this moment of severe inequality - which is a part of the crisis, the climate conversation. We need to find ways to move capital to where it is most needed and not just to where it is safe.

Jacqueline Novogratz

CEO and Founder, Acumen

Climate funds

GCF is committed to ensuring that its activities are complementary and coherent with those of other funds in supporting the climate ambitions of developing countries. In 2021, it cemented an alliance with the Global Environment Facility (GEF), the “Long-Term Vision on Complementarity, Coherence, and Collaboration between GEF and GCF” that will identify areas of cooperation to support developing countries and to unlock new opportunities in mobilising climate finance. GCF, with the other climate funds, also released public statements on the support climate funds are providing to developing countries and on supporting their economic recovery from COVID-19.

Climate Adaptation Summit

GCF affirmed its support for an increase in global adaptation financing and presented its work with the Coalition for Climate Resilient Investment (CCRI) and its support to the Global Sub-national Climate Equity Fund.

GCF Caribbean Regional Dialogue

The virtual event, with Barbados Prime Minister Mia Mottley and Belize Prime Minister John Briceno, was a chance for GCF to better understand the climate finance needs and priorities of Small Island Developing States (SIDS).

GCF had various engagements such as regional DAE workshops in Asia and Africa, and meetings with Permanent UN Representatives from the Alliance of Overseas Small Island States (AOSIS) and the Least Developed Countries Group.

2021 Leaders’ Summit on Climate

GCF held a virtual event on 20 April in the margin of the summit to highlight its role in accelerating the transition to low emission, climate-resilient pathways; a statement from the US Special Presidential Climate Envoy John Kerry described GCF as an “indispensable player”.

2021 P4G Summit

GCF was present at several events of the annual summit hosted by South Korea that year, which helped to lay the groundwork for COP 26. GCF co-hosted with the South Korean Ministry of Economy and Finance the “Green New Deal: Clean Transition to Green Economy”.

Publication Highlight

GCF’s report, “Scaling up climate finance in the context of COVID-19” looks at aligning finance with sustainable development in order to achieve the Paris Agreement goals and economic recovery from the global pandemic.

29th Meeting of the GCF Board (B.29)

The Integrated Results Management Framework (IRMF) and results tracking tool, which will help GCF better track and manage results, were adopted at the virtual Board meeting. This was one of three virtual Board meetings in 2021 (others in March and October). The Board approved nearly USD 3 billion of GCF resources for 32 new climate projects for the year.

IUCN 2021 World Conservation Congress

GCF participated at several events, and notably with GEF shared a roadmap for long-term complementarity to mobilise finance for climate action and nature protection. A new partnership between the two organisations would be announced at COP26.

High-level meetings in the lead up to COP26

In preparation for COP26, GCF Executive Director Yannick Glemarec engaged in a series of high-level meetings on the sidelines of the 76th UNGA in New York, including bilaterals with Senegal President Macky Sall, UN Secretary General Antonio Guterres, and COP26 President Alok Sharma. A mission to Barbados for a meeting with Prime Minister Mia Mottley and a dialogue with CARICOM leaders subsequently took place.

GCF’s 4th Private Investment for Climate Conference (GPIC)

In its fourth year, the virtual two-day event featured 45 speakers in eight sessions and >1,500 participants from >100 countries. Costa Rica President Carlos Alvarado Quesada, Gabon President Ali Bongo Ondimba, Acumen founder and CEO Jacqueline Novogratz, and Convergence CEO Joan M. Larrea were among the speakers. Discussions were on the role of GCF’s Private Sector Facility (PSF) and on private sector investment in adaptation, ecosystem-based solutions and innovative technologies.

COP26 UN Climate Conference

With a small delegation in Scotland to reduce COVID-19 risks, GCF held >180 bilateral meetings and 42 events and >150 speakers at the joint GCF-GEF pavilion, with events livestreamed on the GCF COP website. GCF announced several initiatives such as “The Long-Term Vision on Complementarity, Coherence, and Collaboration between GEF and GCF”, launch of the “Climate Science Information for Climate Action” tool with the World Meteorological Organization, launch of the ASEAN Catalytic Green Finance Facility, and the signing of a funding agreement for the Africa Integrated Climate Risk Management Programme.

Publication Highlight

With a foreword by Barbados Prime Minister Mia Mottley, GCF’s new working paper, “Accelerating and scaling up climate innovation: How the Green Climate Fund’s approach can deliver new climate solutions for developing countries” identifies the barriers to climate innovation in developing countries and how GCF helps overcome these barriers.

Progress on GCF’s

Updated Strategic Plan

2020 - 2023

The Updated Strategic Plan 2020 – 2023 (USP), endorsed by the GCF Board in 2020, serves to guide GCF in addressing policy gaps, programming, and investing resources in paradigm-shifting climate actions in a country-driven manner for the first replenishment period (GCF-1). The USP sets out strategic objectives, guidelines for resource allocation, and strategic, operational and institutional priorities for GCF to achieve its long-term vision.

GCF’s Long-term vision

- Promote the paradigm shift towards low emission and climate-resilient development pathways in the context of sustainable development.

- Support developing countries to raise and realise their climate ambitions in line with the objectives of the Paris Agreement and the UN Framework Convention on Climate Change.

GCF-1 Outcomes (2020 – 2023)

- Balanced, scaled-up funding between adaptation and mitigation, with a 50 per cent adaptation ‘floor’ reaching the most vulnerable countries (Least Developed Countries, Small Island Developing States and African States).

- Significant increase in direct access funding, working directly with local, national, and regional organisations that are close to the ground in developing countries, alongside work with larger, international entities.

- Significant increase in mobilisation from the private sector, using GCF investments to leverage more private investments and increased share of programming resources that flow through GCF’s Private Sector Facility.

- Improved speed, predictability, efficiency, effectiveness and transparency to maximise the impact of GCF’s climate action.

- Deliver over 265 million tonnes of CO2 reductions or removals per billion dollars invested in mitigation and reach over 155 million beneficiaries for each billion invested in adaptation

GCF-1 Priorities

- Strengthen country ownership of programming

- Foster a paradigm-shifting portfolio

- Catalyse private sector finance at-scale

- Improve access to GCF resources

As of the end of 2021 and at the midpoint of GCF-1, GCF is in a stronger position than ever to fulfill its mandate as an operating entity of the Financial Mechanism of the UNFCCC and to contribute to realising the ambitions of developing countries, as set through their Nationally Determined Contributions (NDCs), adaptation plans and climate strategies under the Paris Agreement.

| Activity | GCF-1 Midpoint Progress |

|---|---|

| Strengthening capacity to implement climate strategies and access financing |

Readiness investments helping 141 developing countries. DAE programming increased from 12 per cent of programming in IRM to 23 per cent of programming in GCF-1. DAEs represent 83 per cent of new AEs in GCF-1. |

| Building a portfolio over USD 10 billion aligned with GCF-1 goals |

Portfolio reached USD 10b in 2021 – ~USD 5b programmed in the first two years of GCF-1 with ~USD 3b in 2021. Total value of portfolio is >USD 37b with USD 27.1b of co-financing. Increase in share of DAE and adaptation programming with the private sector. |

| Accelerating implementation to deliver resources on the ground and managing the portfolio |

Projects under implementation reached about 80 per cent of the portfolio. Disbursements reached USD 2.3b, increasing total funds disbursed by 53 per cent since the end of 2020. Median times from Board approval of a project to disbursement decreased. Portfolio management capacities strengthened. |

| Maturing GCF processes and increasing institutional capacity |

Streamlining, codifying, automating, and digitising processes improved speed, efficiency, and transparency. GCF to increase staff capacity in the second half of GCF-1 following Board approval in 2021 to increase the Secretariat headcount. |

GCF chronology

Initial Resource Mobilisation (2014 -2019)

Establishment of the GCF headquarters and Secretariat in the Republic of Korea; approval of initial policies by GCF Board to guide GCF’s work and on the use of its resources; first climate projects approved and implemented; and first replenishment realised.

GCF-1 (2020 – 2023)

Significant growth of GCF and portfolio; portfolio reached USD 10 billion with 190 projects in 127 countries at the end of 2021; maturation of GCF with more ambitious and sophisticated strategy, programming and operations, and rapidly increasing institutional capacity; preparation for the second replenishment in 2023.

GCF-2 (2024 – 2027)

Finance provided on terms below market makes it possible to de-risk new technologies to boost private investment, to pioneer new approaches, pilot new ideas, demonstrate new concepts, and help build up the resilience of the poorest communities. This is obviously where the Green Climate Fund is an indispensable player.

John Kerry

U.S. Special Presidential Envoy for Climate

Administrative budget

GCF’s administrative expenses for 2021, compared to total contributions (received and signed contribution agreements), are 0.4 per cent. These expenses cover the operations of the Secretariat (including staffing costs, contractual services, consultancies, and travel), as well as Board activities, and Trustee activities.

The Secretariat costs for the year amounted to USD 62.5 million. They were allocated according to the breakdown in the chart, with travel costs in particular still significantly reduced due to the ongoing pandemic. GCF’s financial statements are audited each year by an independent auditor. These are usually available in the third quarter of the following year. Previous audited financial statements are available via g.cf/financialstatements.

GCF Secretariat 2021 Expenditure

Status of contributions

GCF’s first replenishment (GCF-1: 2020 2023) is an important element of the financial commitments needed to deliver the Paris Agreement. By the end of 2021 – the halfway point of GCF-1 – contributors have pledged well over USD 10 billion to GCF (based on exchange rates at the time).

Ninety-eight per cent of these pledges have already been confirmed, with all 34 contributors having confirmed part or all of their pledges through the signing of contribution agreements, as indicated in the table, which uses a USD equivalent reference rate for individual contributions. The current status of contributions is available on the resource mobilisation section of the GCF website.

GCF-1 Pledges

GCF financial flows (in USD billions*)