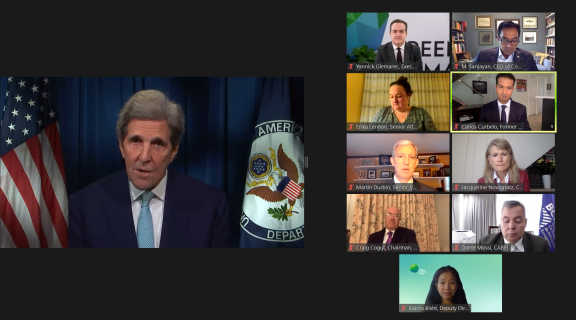

US climate envoy supports “indispensable” GCF role during climate forum

US Special Presidential Envoy for Climate John Kerry has said the US will provide strong support to the Green Climate Fund (GCF) as an “indispensable player” in financing global endeavours to achieve the Paris Agreement and protect poor and vulnerable people exposed to the climate crisis.

“President Biden and I wanted to send a clear signal that we value the Fund's work, and we look forward to investing in its work in the years ahead,” Kerry said on Tuesday during an online dialogue on climate finance opportunities in developing countries, ahead of the US Climate Leaders Summit.

During the wide-ranging discussions, including a number of GCF financing partners, Kerry said the importance of GCF extended far beyond its role in providing climate finance to developing countries.

“More than that, we need the GCF to also enable countries to build up their own technical capacity, unlock new capital, drive technological change, and shift the world into alignment with the Paris agreement goals,” he said in a pre-recorded speech.

“The GCF is now delivering on this promise. When we adopted the Paris agreement, the Fund was just approving its first projects. Five years later, the GCF has a portfolio of 173 projects in every region in the world, with a total value of over 30 billion. Many of these projects are enabling countries to put new ideas to work and to scale up existing ideas.”

The US climate envoy, who indicated climate change posed both an environmental justice hazard and a commercial opportunity if addressed through decarbonisation, was a key speaker at the GCF event “The Climate Finance Opportunity in Developing Countries: How the Green Climate Fund Delivers Climate Action.”

John Kerry on the importance of climate finance in driving climate action

GCF Executive Director Yannick Glemarec told participants the “renewed, strong commitment of the US to the Paris Agreement, and to the Green Climate Fund, is a hugely positive development.”

“And we certainly welcome the recent announcement by the US Administration that it will ask Congress for USD 1.25 billion in funding for GCF during this budget cycle,” he added.

Stressing the urgency of enhancing climate action, Glemarec highlighted the paradox where large global financial reserves are not flowing to developing countries, despite the abundance of climate finance opportunities in these countries valued at up to USD 23 trillion between now and 2030.

Pegasus Capital Advisors CEO Craig Cogut emphasised the need for investors to take on financial risk to fill the wide dearth of finances available for new climate sectors in developing countries beyond renewables, such as waste water technologies and agriculture.

“We need people to take risks to spur innovation and the challenge, I think, is to give people comfort and knowledge about the new sectors,” he said. While calling for involvement with governments at all levels, he stressed the need for “changing the perception of risk, and that’s a big part of what the Green Climate Fund is doing.”

GCF is partnering with Pegasus on a USD 750 million private equity fund to invest in adaptation and mitigation priorities at the sub-national level in 42 countries across four regions.

Conservation International CEO M. Sanjayan highlighted the way that nature-based climate solutions are also helping developing countries weather the economic fallout from COVID-19.

“The thing about investing in nature, natural climate solutions and nature-based solutions - both for climate mitigation but also adaptation - is that it also provides rural jobs, the ones that are going to be the hardest to recover in a post-COVID environment,” he said.

Sanjayan linked this to the way GCF finances are helping foster a green, resilient recovery in COVID-19-battered developing countries. This includes Conservation International’s partnership with GCF in helping to enhance the resilience of smallholder farmers in Madagascar.

The representative of another GCF partner, Acumen CEO Jacqueline Novogratz, noted the need to increase climate finance flows quickly to deal with the global dislocation caused by COVID-19, including the strain faced by fledgling renewable companies in Africa.

Novogratz said: “When it was clear within five or six months of the pandemic that already 30 percent of the 500 off-grid energy companies had collapsed, losing tens of thousands of jobs, we worked with GCF and a number of other institutions and helped catalyse what we hope will close as a USD 90 million dollar facility to provide concessionary debt, guarantees and philanthropy.”

The CEO added that GCF moved “very quickly” to bring in nine African countries to form the energy access facility, designed to enable African energy companies meet their short-term liquidity crisis.

A key theme of the GCF forum was the need to drastically increase both the volume and pace of financing to reduce emissions and deal with worsening climate effects.

“Investments in climate change are urgent, and we need to prepare now,” said Executive President of Central American Bank for Economic Integration (CABEI) Dante Mossi. While the Central American region is hit by hurricanes annually, two in the space of two weeks last year caused USD 3 billion in damage, said Mossi.

He emphasised the need to open up greater access to global markets was key to driving climate action in developing countries. CABEI is working with GCF to harness the private sector in funding adaptation measures by providing concessional loans and technical assistance to investors in farming across seven Central American countries.

Event speakers

Highlighting the multifaceted nature of climate change, Senior Attorney in the Climate and Energy Program at the Center for International Environmental Law (CIEL) Erika Lennon said the “climate crisis is the greatest human rights challenge of our time.”

“As the climate emergency worsens the need for predictable and accessible finance does too, especially as the climate emergency and COVID pandemic compound the issues facing communities around the world,” she added.

Meanwhile in a sign of the business momentum that is needed to address climate change, Martin Durbin said the US Chamber of Commerce - where he is a Policy Senior Vice President - has a consensus on tackling the crisis.

GCF Executive Director Yannick Glemarec will be participating in the US Climate Leaders Summit later this week.

What makes GCF a valuable climate action partner?

How do we mobilise private investment for climate?

Full recording