Climate action

during the

pandemic

GCF snapshot

0

0

0

0

0

0

0

6 Accredited Entities

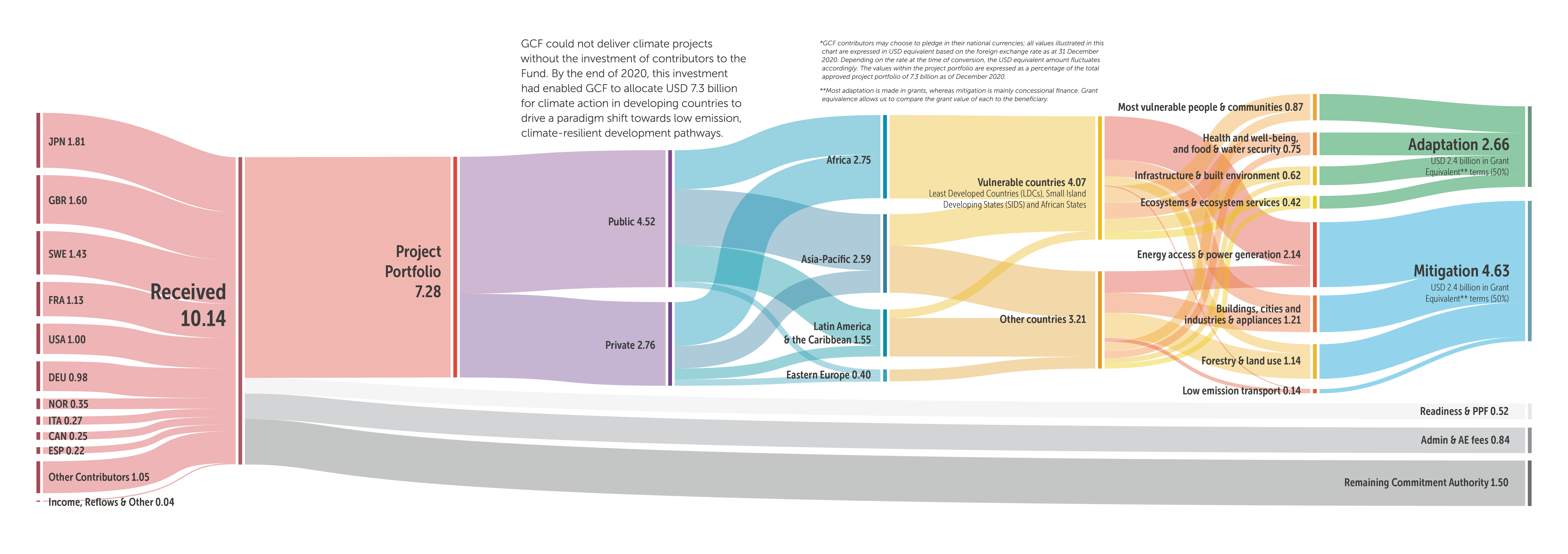

Approved projects value by theme (Grant equivalent*)

Approved projects value by priority countries

* Nominal values are used throughout unless it is indicated that figures are grant equivalent. The grant equivalent calculator tool, developed by the Office of Risk Management and Compliance of GCF, converts the value of different grant and non-grant instruments into a comparable grant equivalent value. The grant equivalents were estimated for each project using a uniform five per cent discount rate.

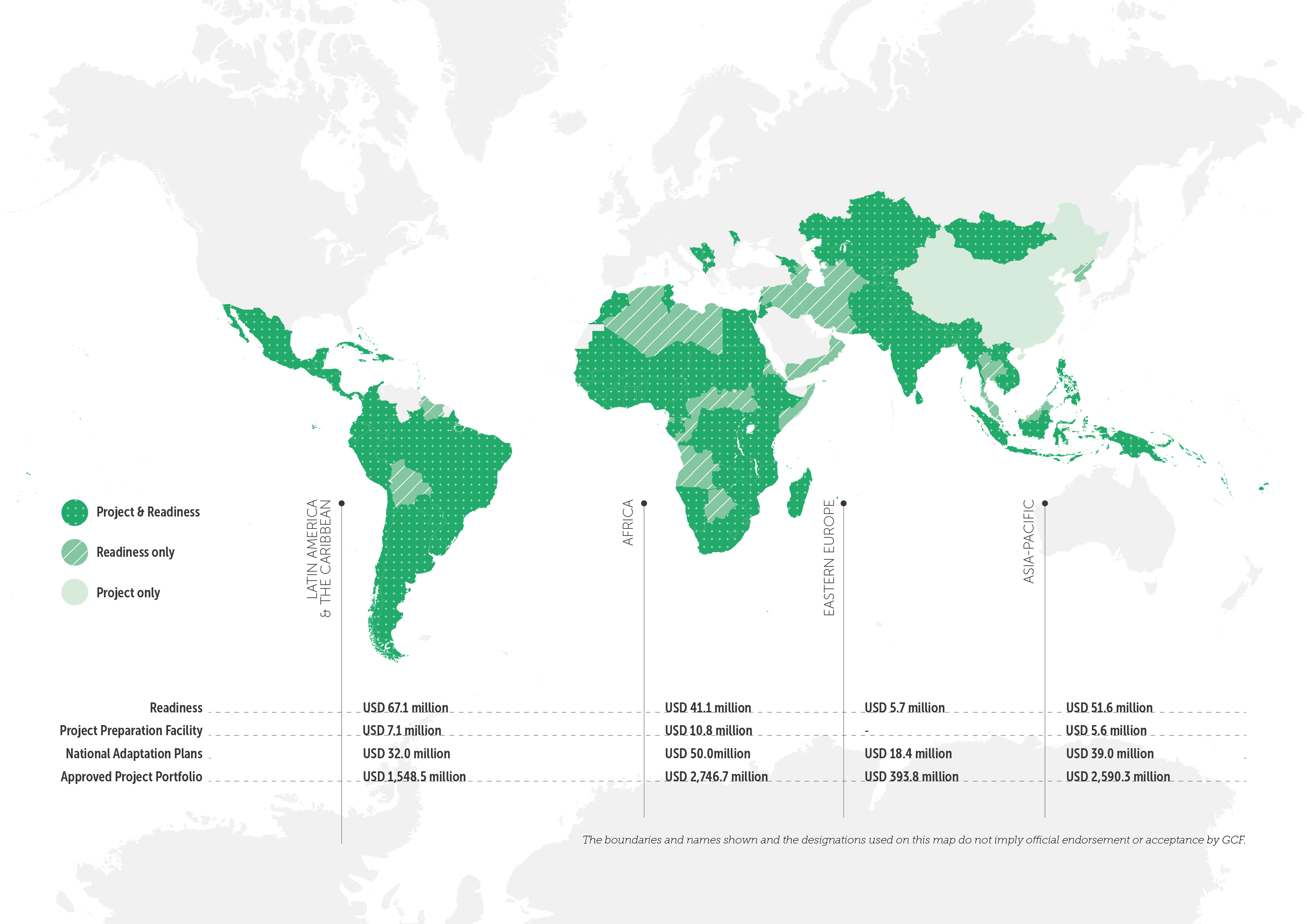

Geographic distribution of GCF projects (as of 31 Dec 2020)

Letter from the Executive Director

With USD 10 billion pledged to date for the first replenishment of the Green Climate Fund, we started 2020 with high hopes as we stepped into the last year of the decade. Supposedly the year of climate action, 2020 became known as the year of the pandemic. COVID-19 created an unprecedented public health challenge, which added the burdens of health and economic crises on top of the global climate crisis.

By taking a proactive approach, collaborating closely with our partners, and digitalising our business processes, we were able to mitigate the impacts of the pandemic upon climate action and support a low emissions climate-resilient recovery during this most challenging of years. Over 70 per cent of the GCF project portfolio is now under implementation, and in spite of the pandemic we achieved our target of disbursing USD 1.5 billion in climate financing by the end of 2020. Notably, our three Board meetings of the year resulted in a record annual level of approval – USD 2.1 billion in GCF resources were approved for climate finance projects around the world, keeping up the momentum for climate action at a time when the world needed it the most. Last year we also made grants totalling USD 200 million from our readiness programme, building countries’ capacity to turn climate ambitions into bankable plans, and provided early-stage project development funding through our Project Preparation Facility. We increased our support for direct access to national and regional organisations, including our collaboration with the International Development Finance Club (IDFC) to promote the role of National Development Banks.

The success of any organisation - whether international or domestic, public or private, large or small - depends on its people. GCF is no exception. I am proud of the Secretariat – the talent, dedication, commitment, and perseverance of our people – for delivering record results in 2020. It was an exceptionally difficult year for the Secretariat that included the death of one of our colleagues, Leonardo Paat Jr., GCF’s Environment and Social Safeguards, Gender and Indigenous Peoples Manager, from COVID-19 complications, a loss that touched us all deeply.

This Annual Results Report provides an account of our efforts, as the world’s largest dedicated climate fund, to increase the speed and delivery of climate finance to drive the paradigm shift towards low emission and climate-resilient development pathways in line with the objectives of the Paris Agreement and the Sustainable Development Goals (SDGs).

Our strategy for the GCF 2020 – 2023 programming period is guided by our commitment to focus on achieving an increased impact for developing countries to deliver more ambitious nationally determined contributions. We aim to support the strong demand from non-Annex 1 countries for funding for high-impact adaptation and mitigation projects, while maintaining a floor of 50 per cent of adaptation allocation for vulnerable countries (LDCs, SIDS, African States). We are also working to significantly increase our resource allocation to Direct Access Entities who are closest to the needs on the ground, as well as leveraging more private investment and increasing the allocation to our Private Sector Facility.

GCF has the capacity to transform climate finance, and by doing so, to deliver on our mandate. The delayed COP26 climate conference at the end of 2021 will be a significant moment in the fight against climate change. Based on our new strategic plan and equipped with the USD 10 billion raised to date by our first replenishment, GCF will build on its 2020 achievements this year, supporting the efforts of developing countries as they take urgent climate action whilst moving towards a green, resilient recovery.

Yannick Glemarec

GCF Executive Director

GCF 2020 Highlights

-

Informal Board Meeting in Liberia to discuss the draft Updated Strategic Plan

- Special Flexible Working Arrangements for GCF personnel in response to the COVID-19 pandemic in South Korea. HQ in G-Tower remains open for essential staff

- GCF opens an Annex office near G-Tower to be used in case of emergency

- B.26, the first virtual GCF Board Meeting

- GCF personnel return to work at G-Tower with the flexibility to work remotely as needed

-

GCF organises its first virtual high-level event on the sidelines of the High-Level Political Forum on Sustainable Development

- The Ministry of Economy and Finance of the Republic of Korea and GCF host an International Conference on the Green New Deal: Green stimulus in the post-COVID-19 era and beyond

-

GCF holds a virtual Leadership Dialogue in the margins of the 75th UN General Assembly

-

3rd GCF Private Investment for Climate Conference (GPIC2020)

-

B.27 Board meeting (virtual)

GCF's Updated Strategic Plan 2020-2023 is approved

GCF’s Private Investment for Climate Conference 2020 (GPIC2020) breaks records

Investors at GPIC2020 flagged the COVID-19 pandemic as a wake-up call for efforts to shift portfolios towards climate-friendly investments. GCF was recognisd as a key partner for the private sector, unlocking green investment opportunities and thereby helping developing countries reach their climate ambitions.

- First virtual GPIC2020

-

55 speakers, featuring high-level speakers

-

- Over 2,200 online participants

- 134 countries represented

- 84 banks and institutional investors

- Participants represented USD 8+ trillion assets under management

A tribute to Leonardo Paat Jr.

23 February 1971 – 5 August 2020

Leo joined GCF in 2016. Throughout the short life of our young organisation, he combined environmental expertise with a calming and unflappable personality. Arriving at GCF at a time when the Environment and Social Safeguards (ESS) team was just being established, he used his determination, diplomacy, and expertise to raise the profile of ESS, grow the team, and develop the safeguards policies and practices that are so essential to GCF’s work.

Leo left a legacy of personal and professional achievements, and made a huge contribution to the Green Climate Fund. We count ourselves very fortunate to have benefitted from his passion, commitment, and expertise, and continue to mourn his loss.

Empowering climate action in 2020

Maintaining operations in the new environment

From the outset of COVID-19, GCF sought to ensure that the impact of the pandemic on its operations would be minimised. The Fund adopted a three-level strategy to promote personnel safety and business continuity:

- A new way of working: the digital agenda

- A new working environment

- Ensuring business continuity

Supporting a green resilient recovery

GCF developed both a short-term and a longer-term response to support a green resilient recovery. In the short-term, GCF moved rapidly during 2020 with a three-pronged approach to maintain climate ambition during the pandemic:

- Adaptive portfolio management

- Support for developing country recovery planning

- Accelerated pipeline of climate projects with strong co-benefits

For its longer-term response, GCF is working on several follow-up initiatives to roll-out during the GCF-1 period:

- Transformational planning and programming

- Catalysing climate innovation

- Mobilising finance at scale

- Aligning finance with sustainable development

Leveraging partnerships

As a partnership institution, GCF depends on engagement with partners to deliver its mandate. During the pandemic, GCF transitioned to virtual engagements to provide essential support to developing countries such as holding bilateral technical discussions and regional webinars on programming matters.

The Fund also co-published two reports:

- Synergies between Climate Finance Mechanisms with the Climate Investment Funds in April 2020; and

- GCF and IDFC: A strategic alliance to realise the full potential of public development banks in financing the green and climate-resilient transition with the International Development Finance Club in November 2020.

The important work of the Green Climate Fund is required more than ever as we accelerate the decarbonisation of the global economy and try to strengthen resilience and adaptation across the developing world. Let’s continue to find those solutions together for a low carbon, resilient future that leaves no country behind.

Amina J. Mohammed

United Nations Deputy Secretary-General

at GCF’s Private Investment for Climate Conference 2020

Delivering results

Swift programming

2020 was a record year for GCF programming despite the challenges posed by the COVID-19 pandemic. The GCF Board approved over USD 2 billion worth of new climate finance for innovative climate projects in developing countries around the world.

GCF continues to strive to accelerate the speed of climate finance, particularly the transition from project origination to funding approval. A notable example in 2020 was the Energy Access Relief Facility (EARF), a concessional debt fund. This facility was approved at the B.27 Board meeting only four months after submission of the funding proposal by Acumen. The year also saw an expansion of GCF’s geographic reach. Seventeen out of the 77 developing countries that benefited from new project approvals in 2020 received GCF climate financing for the first time.

Simplified Approval Process (SAP)

0

0

Project preparation Facility (PPF)

0

0

GCF financing for projects approved in 2020

Click on a bar to visit a project page

* Non-USD values have been revalued into USD equivalents based on 31 December 2020 exchange rates.

Project focus

Take a closer look at some of the high-impact mitigation and adaptation projects GCF approved for climate financing in 2020.

FP138

Keeping the light on renewables through the darkness of COVID-19

-

Total project valueUSD 243.2 million

-

GCF financingUSD 90.1 million (loan), USD 2.2 million (grant)

-

Tonnes of emissions avoided1.1 million

The COVID-19 economic crunch threaten progress towards the goal of ensuring access to clean energy for all. In Senegal, about 58 per cent of people in rural areas do not have electricity. In partnership with the West African Development Bank (BOAD), GCF is supporting the Government of Senegal to achieve universal energy access by 2025. By providing affordable funding in the form of low-interest loans, GCF resources will mobilise the private sector to invest in solar-powered mini-grids for the electrification of 1,000 isolated villages. Using the public-private partnership business model for investing and operating small-scale mini-grids, this project aims to drive a post-COVID-19 green recovery whilst delivering green energy to millions for the first time, especially in rural, off-grid areas.

SAP017

Climate proofing agroecosystem investments in Burundi

-

Total project valueUSD 31.7 million

-

GCF financingUSD 10.0 million (grant)

-

Tonnes of emissions avoided2.9 million

The combination of extreme floods and droughts in the Imbo and Moso basins of Burundi is expected to cause a 5 to 25 per cent decline in agricultural yields. Working with IFAD, GCF is helping farmers in this area to manage their crops and water supply so they can increase their resilience to climate change. The project’s three components – adoption of best practices in agroecosystem management to improve soil and water management; capacity building; and development of an enabling environment for soil and water conservation – aim to increase agricultural productivity and the long-term food security of Burundi. GCF’s grant is crucial to overcoming the barriers of these types of adaptation investments, without adding to the debt situation of the country.

SAP013

Solar microgrids bring affordable electricity to rural Haiti

-

Total project valueUSD 45.7 million

-

GCF financingUSD 8.4 million (loan), USD 1.5 million (grant)

-

Tonnes of emissions avoided214.4 thousand

Solar-powered microgrids are the lowest-cost, most resilient, and most climate-friendly method of quickly delivering quality energy services in rural areas. In Haiti, GCF and the Nordic Environment Finance Corporation are building 22 community-scale solar plus battery storage micro-grids in areas where no grid power exists. Using a “feminist electrification” approach, the project provides affordable and reliable 24/7 access to energy services, with technical assistance for targeting women as both microgrid entrepreneurs and customers. GCF support accelerates the shift to off-grid electrification in the country and changes the risk perception for these types of climate investments, enabling this innovative clean energy project to be replicated.

FP152

Tapping scalable climate solutions with blended finance

-

Total project valueUSD 750.0 million

-

GCF financingUSD 150.0 million (equity)

-

Tonnes of emissions avoided77.6 million

Seventy per cent of known climate solutions lie within the boundaries of subnational authorities. However, most of these projects are bypassed by commercial investors for traditionally safer and larger investments. By providing anchor funding and first-loss coverage to the Sub-national Climate Fund Global (SnCF Global), managed by GCF’s AE Pegasus Capital Investors, GCF is catalysing a transformative financing model of how subnational climate projects should be structured, de-risked, and funded by both private and public investors, while monitored and benchmarked at the highest level. This is the first time an impact equity fund has mobilised public (20 per cent) and private sector (80 per cent) funding at scale to de-risk subnational mid-scale infrastructure projects.

Efficient implementation

Over 70 per cent of GCF’s portfolio is under implementation, with the Fund achieving its target of disbursing USD 1.5 billion in resources by the end of 2020.

During the year, GCF moved 11 newly approved projects to implementation by signing Funded Activity Agreements (FAAs) immediately after their Board approval. GCF aims to make the signing of FAAs for new projects a standard practice at future Board meetings to accelerate their implementation on the ground. Overall, out of the 159 funding proposals in the portfolio, 132 FAAs have been signed, exceeding GCF’s 2020 target of moving projects to implementation by 23 per cent.

Here are two stories that show how GCF projects are having a transformative impact on the lives of people and the planet.

Ensuring effective operations

GCF’s record results in 2020 in spite of COVID-19 were made possible by a series of improvements to the Fund’s organisational design and operational processes, and by the commitment of its personnel to climate action.

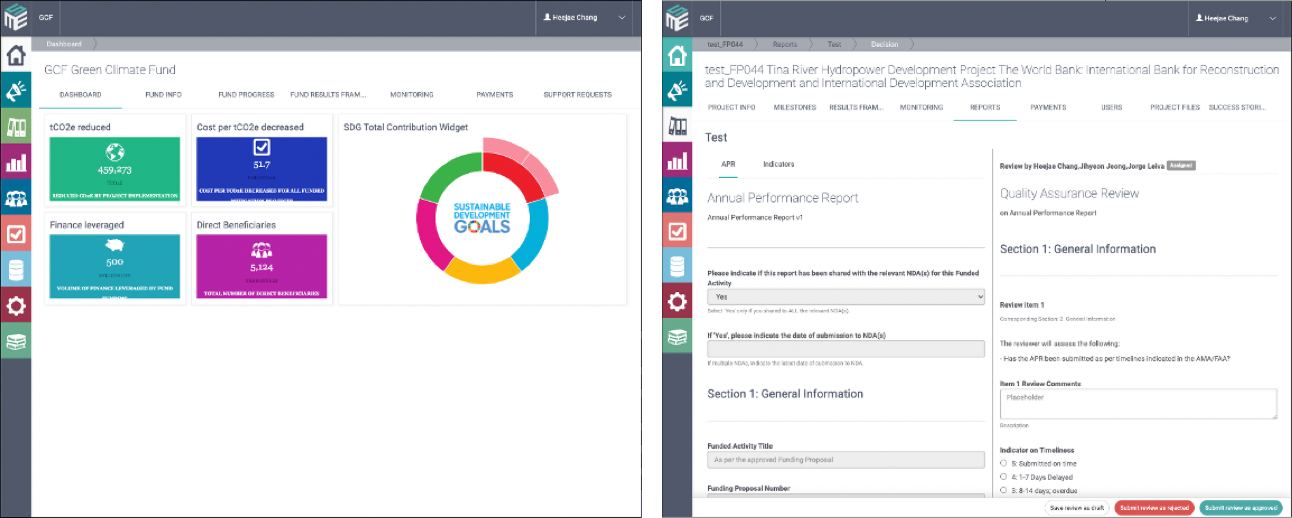

Accelerating the digital transformation was crucial during 2020 to increase the speed, delivery, efficiency, and transparency of operations. Last year, GCF prioritised creating a digital workplace to accommodate a new way of working, digitalising business operations to ensure business continuity, and enhancing digital collaboration. A key milestone was the move to automate and improve the portfolio management capacity of GCF. This gave birth to the new web-based Portfolio Performance Management System (PPMS) which allows AEs to submit project Annual Performance Reports and GCF to track implementation progress and risks to its portfolio.

Furthermore, to simplify the process of accessing the Fund’s resources and increase transparency, GCF published its Programming Manual. It is the ultimate guide on how to prepare and submit a funding proposal that meets the GCF investment criteria.

Portfolio Performance Management System (PPMS)

We’re looking to invest the right kind of capital, in the right kind of character, surrounded by the right community for change . . . Partnership between organisations like GCF and financial intermediaries like Acumen, World Wildlife Foundation, and others . . . moves capital more effectively.

Jacqueline Novogratz

Acumen CEO at GCF’s High-Level Side Event on the sidelines of the

High-Level Political Forum on Sustainable Development 2020

Raising climate ambition: The new GCF Strategic Plan

GCF’s first replenishment (GCF-1) period, from 2020-2023, started with a record year for programming and implementation, and the adoption of a new strategic plan to guide the organisation. The updated Strategic Plan for the GCF 2020 – 2023 programming period reflects the Fund’s commitment to supporting a paradigm shift towards low emission and climate-resilient development pathways in the context of sustainable development.

During the GCF-1 period, GCF will:

- Ensure balanced, scaled-up funding between adaptation and mitigation;

- Significantly increase direct access funding;

- Significantly increase mobilisation from the private sector; and

- Improve speed, predictability, efficiency, effectiveness, and transparency, to maximise the impact of GCF’s climate actions.

Turning low emission, climate-resilient development pathways into reality

Demand for low emission, climate-resilient investments far exceeds the amount of climate finance currently available. To meet the imperative of delivering urgent, ambitious climate impact commensurate with the evolving mitigation and adaptation needs of developing countries, GCF will focus on the following priorities over the GCF-1 programming period:

- Strengthening country ownership of programming

- Fostering a paradigm shifting portfolio

- Catalysing private sector finance at scale

- Improving access to fund resources

GCF’s investment in climate action with high development co-benefits is critical . . . GCF-financed projects translate national climate ambitions into reality and catalyse larger financial flows that are critical for economic recovery.

Leonore Gewessler

Austrian Federal Minister for Climate Action, Environment,

Energy, Mobility, Innovation and Technology at the GCF Leadership Dialogue in the margins of the 75th UN General Assembly

Financial highlights

Administrative budget

GCF’s administrative expenses for 2020 were 0.4 per cent of the total contributions for GCF-1 (received and signed contribution agreements). These expenses cover the operations of the Secretariat (including staffing costs, contractual services, consultancies, and travel), as well as Board activities, and Trustee activities.

The Secretariat costs for the year amounted to USD 52,264,275. They were allocated according to the following breakdown, with travel costs in particular being significantly reduced as a result of the pandemic. Please find the full 2020 financial statements here.

GCF Secretariat 2020 Expenditure

Status of contributions

GCF’s first replenishment (GCF-1: 2020 – 2023) is an important element of the financial commitments needed to deliver the Paris Agreement. By the end of 2020, contributors had pledged well over USD 10 billion to GCF (based on exchange rates at the time). Ninety-six per cent of these pledges have already been confirmed through the creation of contribution agreements, which uses a USD equivalent reference rate for individual contributions. The current status of contributions is available here.

GCF-1 Pledges

GCF financing flows (in USD billions)